FAST replaces cable for majority of cord-cutters, Roku data shows

Weekly insights on the technology, production and business decisions shaping media and broadcast. Free to access. Independent coverage. Unsubscribe anytime.

Roku has released new data showing that 64% of its U.S. households now stream free ad-supported streaming television channels.

The streaming platform operator conducted the study with Horizon Media, analyzing viewership data from 90 million households and surveying 1,500 streamers between Oct. 7 and Oct. 27, 2025. The findings document adoption patterns as viewers move away from cable subscriptions and ad-free streaming services.

Free ad-supported streaming television (FAST) refers to free, live streaming content delivered on a schedule in an electronic programming guide format. The channels operate within streaming apps and platforms, offering viewers access to content without subscription fees.

Since 2020, FAST viewing on Roku Channel increased 262 times faster than the overall TV streaming market, according to Nielsen data cited in the report. The comparison measures the rate of growth rather than absolute viewing hours.

If FAST viewership across all channels were combined into a single application, it would rank as the fourth-largest app on Roku by reach. Currently, 9 in 10 FAST streaming hours on Roku occur within Roku Channel.

The data showed that 57% of Roku homes that streamed only subscription video on demand channels in the first quarter of 2020 now watch FAST content.

Additionally, 70% of FAST viewers on Roku do not subscribe to cable television.

“More US households stream FAST on Roku than watch TNT, TBS, CNN, and Fox News on traditional cable TV,” the report stated.

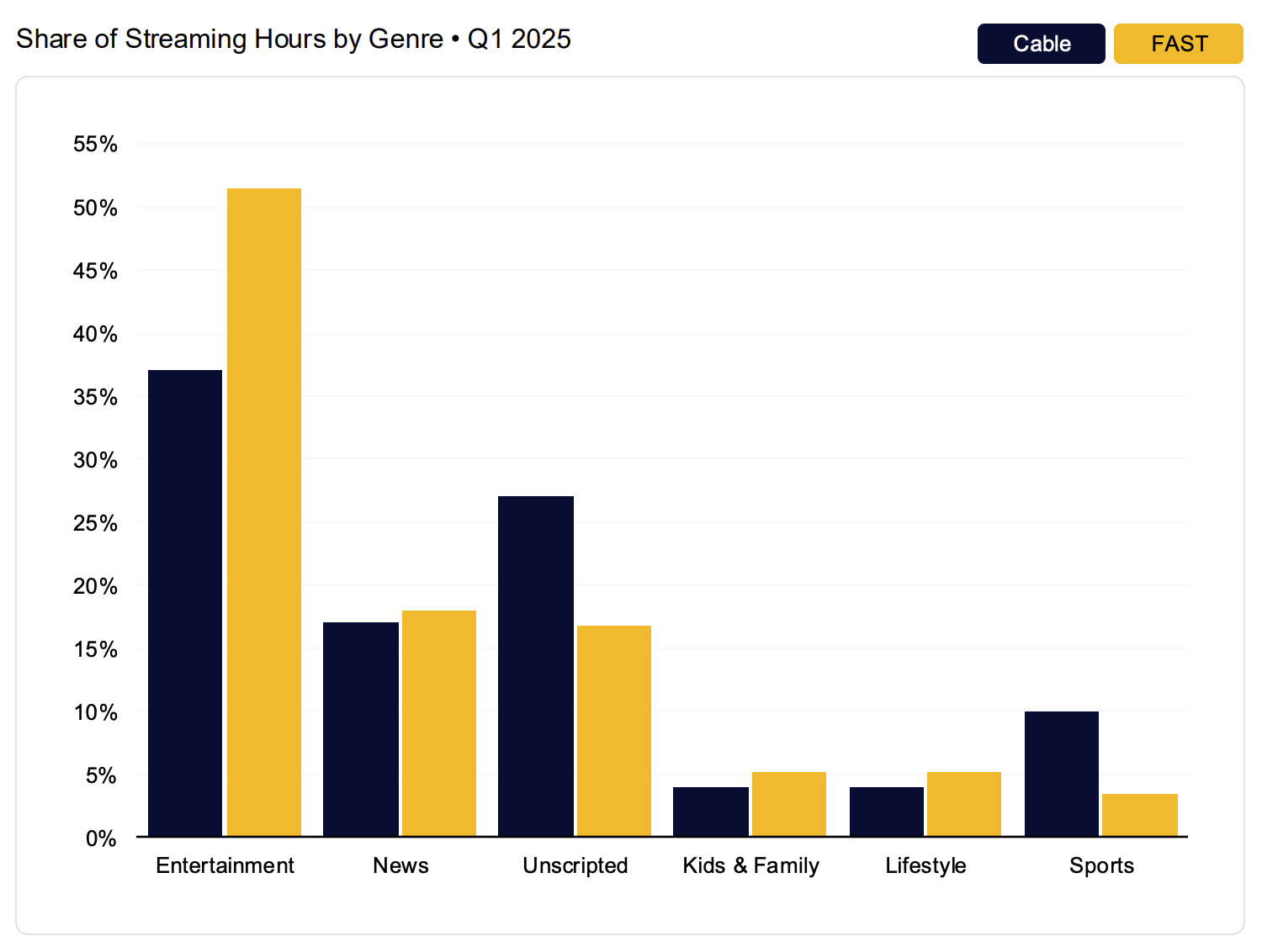

Entertainment content accounts for 52% of FAST viewing hours on Roku Channel, followed by news at 18% and unscripted programming at 17%. Lifestyle, kids and family, and sports content make up the remaining share.

Viewing patterns follow traditional television schedules, with viewership rising throughout the day and peaking during primetime hours. Early morning programming focuses on news and weather, while daytime features music, football and children’s content. Prime time emphasizes action, classic titles and movies, with late-night programming shifting to paranormal, outdoors and mystery content.

Share of Streaming Hours by Genre, data and chart via Roku Advertising report.

FAST viewers saw four minutes of advertising per hour on average, compared to 12 minutes per hour on cable television. The reduced ad load represents one-third of the commercial time found in traditional linear TV.

The report noted that 87% of Roku Channel FAST viewership originates from the home screen rather than from users selecting the Roku Channel app tile. This distribution pattern reflects how viewers discover and access FAST content on the platform.

The demographic composition of FAST viewers on Roku mirrors the platform’s overall user base. Age distribution shows 10% of viewers aged 18-24, 18% aged 25-34, 17% aged 35-44, 18% aged 45-54, 15% aged 55-64, and 22% aged 65 and older.

Compared to audiences streaming FAST on other platforms within Roku, Roku Channel FAST viewers index 36% higher for households earning $200,000 or more annually. They also index 13% higher for graduate degree holders and 9% higher for parents.

The study also examined the overlap between FAST platforms available on Roku.

It found that 74% of Roku Channel FAST viewers do not watch FAST content on Pluto TV or Tubi. In comparison, 80% of Pluto TV’s FAST audience and 83% of Tubi’s FAST audience also watch other FAST services.

The data showed that about 40% of streamers watch FAST because the experience resembles traditional TV with a programming guide and always-available content. Viewers consume an average of 4.1 channels per day and 4.1 hours per day of FAST content, comparable to cable viewing patterns of 4.6 channels and 3.5 hours daily.

Within weeks of canceling cable subscriptions, 65% of homes began watching one hour or more of FAST per week, according to the report.

Viewers reported they are 12% more likely to perceive FAST as delivering premium or high-quality content compared to linear television. More than half of streamers indicated that FAST offers personal favorites they return to regularly.

Roku characterized the findings as evidence that FAST has transitioned from an emerging format to an established component of the streaming landscape. The company positions its home screen integration and content library as differentiators in the FAST market.

tags

Free Ad-Supported Streaming Television (FAST), Horizon Media, roku, The Roku Channel

categories

Featured, Market Research Reports & Industry Analysis, Streaming