Streaming industry shifts focus from growth to retention, Antenna finds

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

Antenna’s latest research report, the Q1’24 “State of Subscriptions” for premium Subscription Video On Demand (SVOD) services, notes a significant transition within the streaming industry, indicating a shift towards a more mature growth phase.

According to the report, the SVOD sector experienced a 10.1% growth in 2023, which, while enviable to traditional media like broadcast TV, marks a decline from the 21.6% surge in 2022.

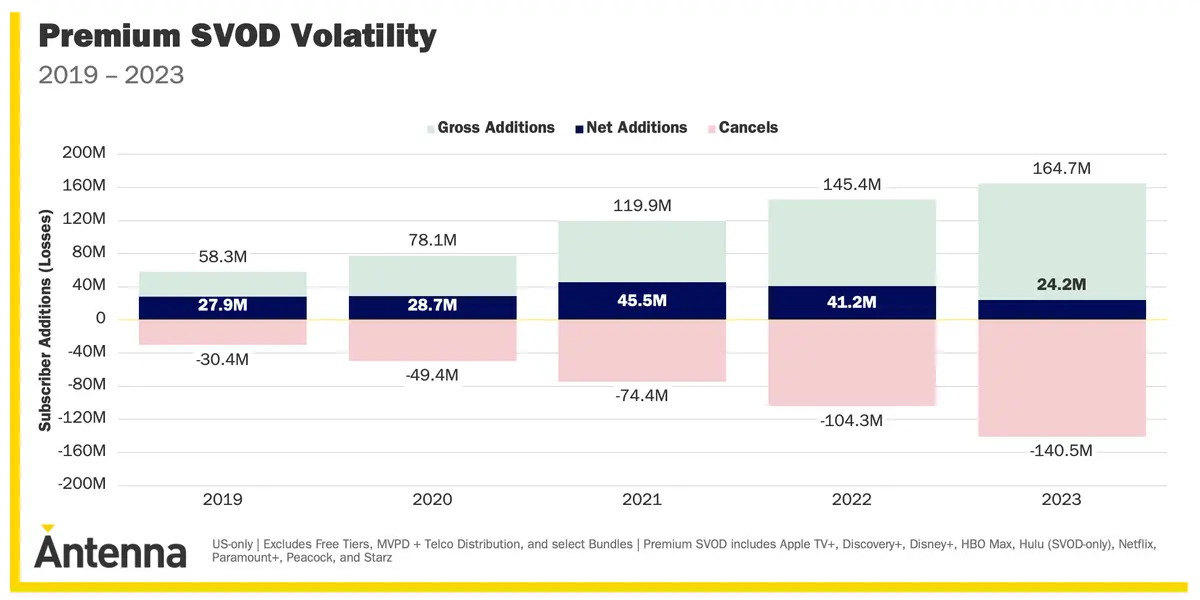

The report highlights increased efforts by streaming companies to maintain their growth momentum, with Antenna’s Weighted Average Churn climbing to 5.5% by the end of 2023, up from the previous year. Despite securing 19.3 million more gross additions in 2023 compared to 2022, the industry faced challenges with 36.2 million more cancellations, resulting in 17.0 million fewer net additions and indicating a slowdown in growth.

Antenna’s analysis suggests that the streaming video sector is navigating towards a new era focused less on subscriber acquisition and more on managing existing subscriber bases. This shift comes as major players have achieved significant scale and niche platforms have made their introductions to targeted audiences. The report underscores the necessity for these services to pivot towards subscriber retention strategies.

Key findings from the report include stabilizing Netflix’s market share, holding steady at 26% of all subscriptions for the first time since 2019, with Peacock, Paramount+ and Netflix driving the most subscriber growth in 2023. The total number of subscriptions reached 242.9 million by the end of 2023.

The study also sheds light on the behavior of “serial churners,” individuals who have canceled three or more premium SVOD services in the past two years, which now represent 23% of all subscribers, up from 17% in 2022. This group’s activity underscores the growing importance of win-back strategies, with the weighted average resubscribe rate rising to 30.1% in 2023.

Additionally, serial churners were identified as a key demographic for acquisition strategies, accounting for all growth in acquisition in 2023 and driving 60.0 million gross additions, a 36.2% increase year-over-year. In contrast, gross additions by non-serial churners decreased by 2.0% year-over-year to 99.5 million.

Antenna’s report highlights the evolving dynamics within the streaming industry, emphasizing the critical need for SVOD services to adapt their strategies towards maintaining and expanding their subscriber bases in this new market maturity phase.

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

tags

Antenna, Netflix, Paramount Plus, peacock, Subscription Video on Demand

categories

Market Research Reports & Industry Analysis, Streaming