Consumers have reached ‘peak TV’ with focus shifting to value

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

The golden age of “peak TV” is sunsetting, posing substantial challenges that could curb the growth of subscriber numbers according to the latest findings from Hub Entertainment Research’s annual “Monetization of Video” report.

The market research report suggests most consumers have reached their capacity for television sources and are not actively looking to increase their spending on video entertainment. Close to half of the surveyed consumers noted they have reached their maximum limit of sources. For those who haven’t, the optimal number of services remained consistent at seven.

However, the silver lining for providers is that consumers are still increasing their spending on television and streaming media.

Approximately 44% of consumers admitted to spending more on television than they did a year ago, marking an increase from 34% in 2020. This is notwithstanding the reality that their actual average spending of $85 per month exceeds by 25% what they perceive as “reasonable” for video services.

This is not entirely positive news for providers as the highest spenders are also the most likely to churn. The report found that households with more subscriptions are more likely to cancel a new subscription within six months of acquiring it. This pattern is most prevalent among consumers with four or more subscriptions.

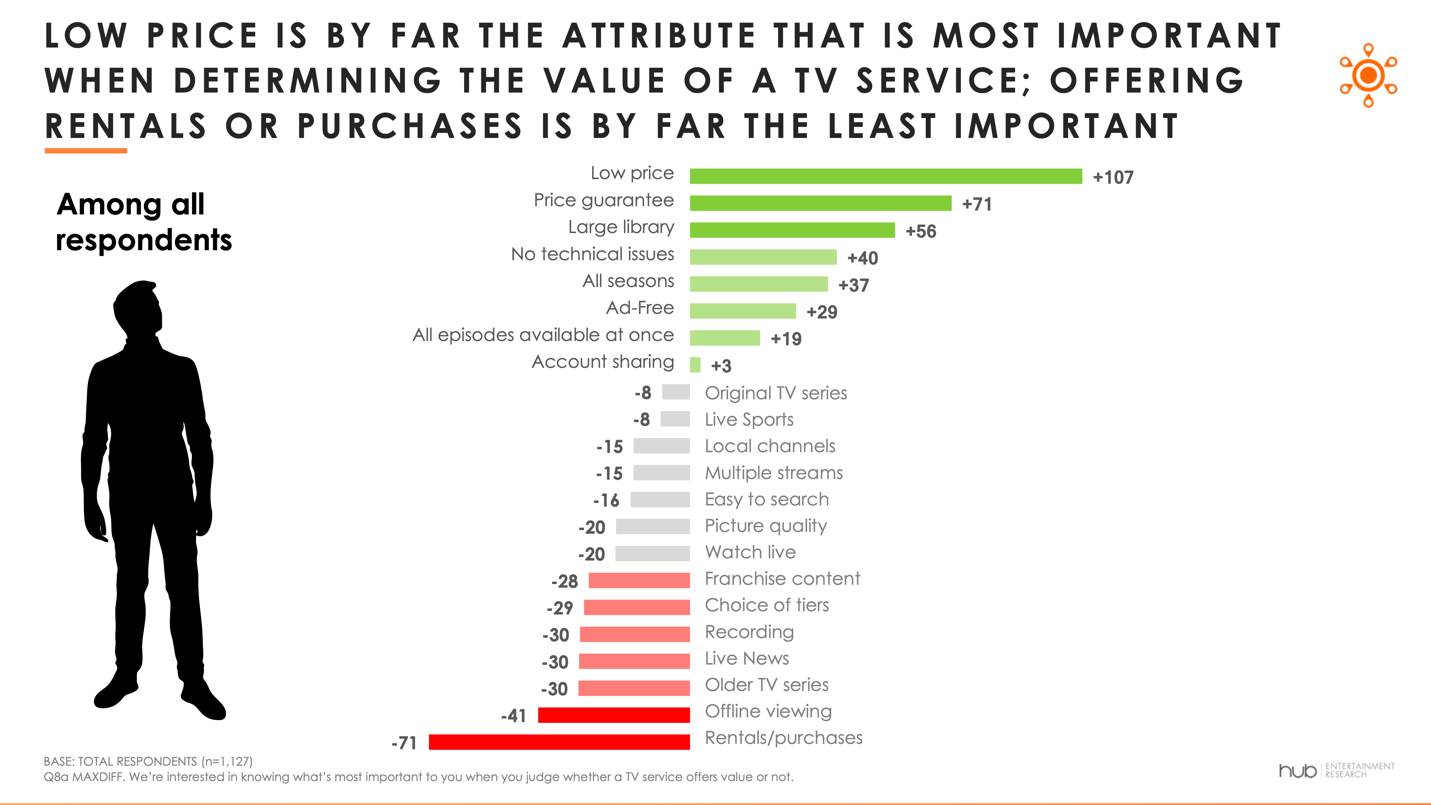

The findings show a clear shift in consumer behavior, placing an emphasis on value. This can be seen through the rapid rise in free ad-supported streaming TV or FAST. Although a low price is a significant factor, consumers also seek price stability and a sizable library of content.

For those without a Multichannel Video Programming Distributor (MVPD) subscription, bundling Subscription Video On Demand (SVOD) services with traditional pay TV services could add value. About two-thirds of this consumer segment claimed such a bundle would make a Pay TV service more valuable to them, marking an increase from 59% last year. Such bundling could potentially reduce subscription cancellations, offering a solution for providers in an environment characterized by subscription churn.

“The video ecosystem is clearly at an inflection point. Gone are the days when providers could reliably count on revenue growth from new subscribers,” said Mark Loughney, senior consultant to Hub. “This leads to a quandary: how to deliver the volume of content necessary to keep subscribers loyal, while at the same time controlling production costs. Reconciling this dilemma will be the key to long term success in the video marketplace.”

Loughney also highlighted the emerging challenge for providers: finding a balance between delivering enough content to retain subscribers while managing production costs. This equilibrium, he says, will be critical for long-term success in the video marketplace.

The “Monetization of Video” report is based on a survey of 1,602 U.S. consumers aged 16-74 who have broadband and watch at least an hour of TV per week. The interviews were conducted in June 2023 and delved into consumers’ attitudes toward their TV service payments and the value delivered by providers.

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

tags

Free Ad-Supported Streaming Television (FAST), Hub Entertainment Research, research, Subscription Video on Demand, survey

categories

Broadcast Industry News, Heroes, Market Research Reports & Industry Analysis, Online and Digital Production, Streaming