Streaming revenue to eclipse pay TV in the US by Q3 2024, Ampere notes

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

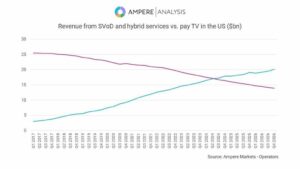

Research by Ampere indicates that revenues from streaming services, including those generated from advertising within hybrid subscription models, is projected to exceed those from traditional pay TV subscriptions by the third quarter of 2024.

This change reflecting a shift in consumer habits towards digital consumption and the strategic responses by media entities to these changes.

Ampere’s analysis reveals that, although the number of streaming service subscribers surpassed those of pay TV in 2016, it is only now that streaming revenues are catching up. This delay is attributed to the lower average revenue per user (ARPU) generated by streaming services, which currently stands at about one-tenth of that generated by pay TV.

The forecasted decline in pay TV’s value, expected to be half of its peak value in 2017 by 2028, contrasts with the growth trajectory of streaming services.

Key to this growth has been the introduction of advertising-supported subscription options. These options have not only facilitated entry into markets that were nearing saturation but have also introduced new streams of revenue. In the current year, revenues from such advertising tiers are anticipated to surpass $9 billion in the United States, with Amazon Prime Video’s new ad tier contributing to this increase.

“Most major streaming services in the U.S. have launched their hybrid advertising tiers, which, along with increasing clamp-downs on password sharing, have been successful at reigniting growth in the streaming market,” said Rory Gooderick, senior analyst at Ampere Analysis.

Efforts to invigorate the streaming market have included the introduction of hybrid advertising tiers and measures to curb password sharing.

Meanwhile, collaborations between streaming services and traditional pay TV providers, such as the partnership between Disney and Charter, illustrate potential pathways for coexistence and mutual benefit. This deal, which extended Disney+’s advertising tier to nearly 15 million Charter subscribers, exemplifies how streaming and pay TV can leverage their respective strengths to enhance service delivery and expand market reach.

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

tags

Advertising-based Video on Demand, Amazon Prime, Ampere Analysis, Disney Plus, Free Ad-Supported Streaming Television (FAST), OTT, streaming, Streaming OTT, Subscription Video on Demand

categories

Featured, Market Research Reports & Industry Analysis, Streaming