Disney+ dives into tighter Hulu integration, changing its logo’s color to promote tie-in

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

Disney+ has launched its direct integration with Hulu.

While the two streamers have offered a bundle for years and a Hulu hub existed within Disney+ since late 2023, the March 2024 update means Hulu content will become more streamlined within Disney+.

Hulu content will be accessed via a dedicated tile within the Disney+ menus.

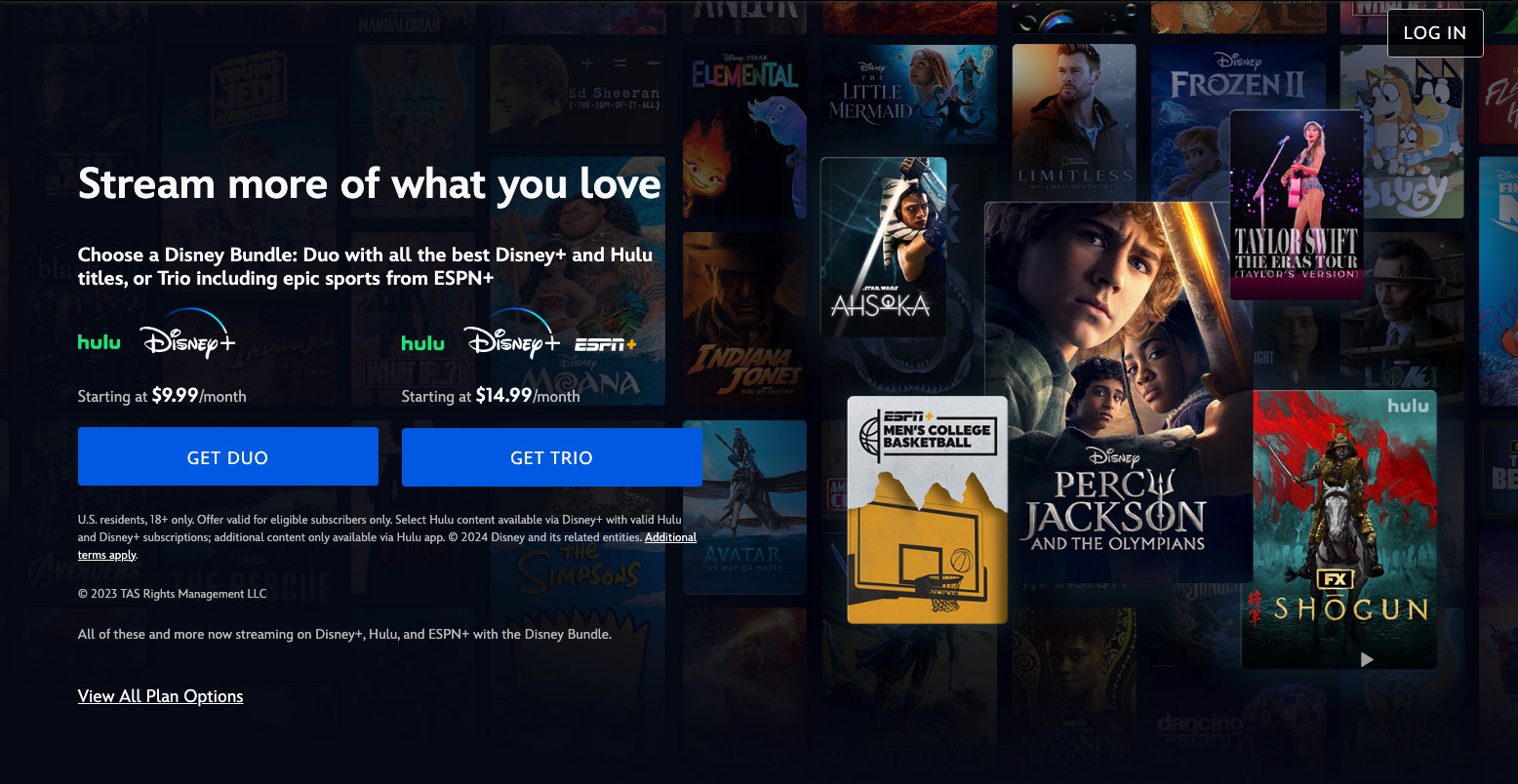

To mark the occasion, Disney+ rolled out an updated website, shifting from its trademark blue to more of a teal — representing a blend of Hulu’s distinctive green and the mouse’s blue.

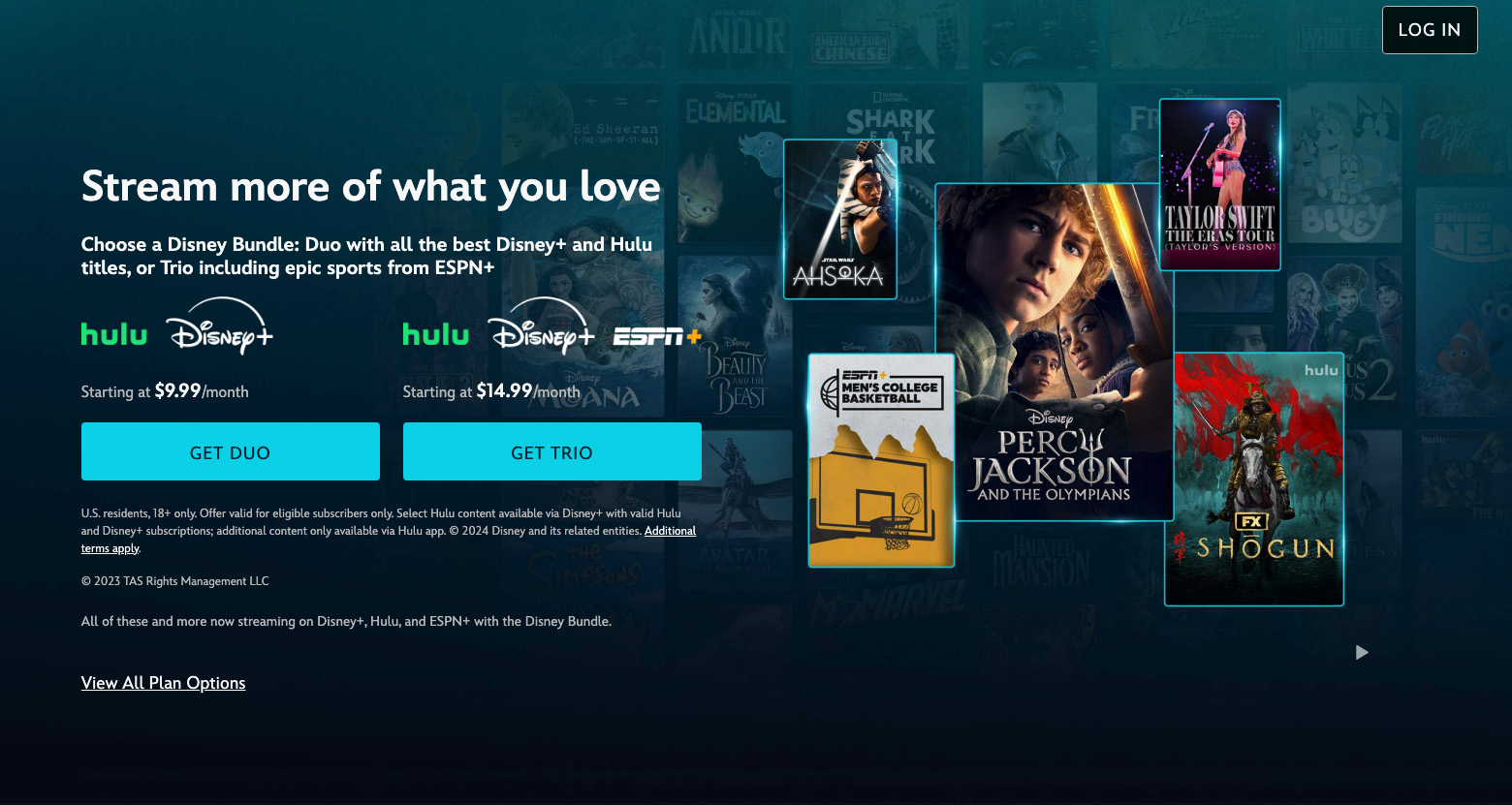

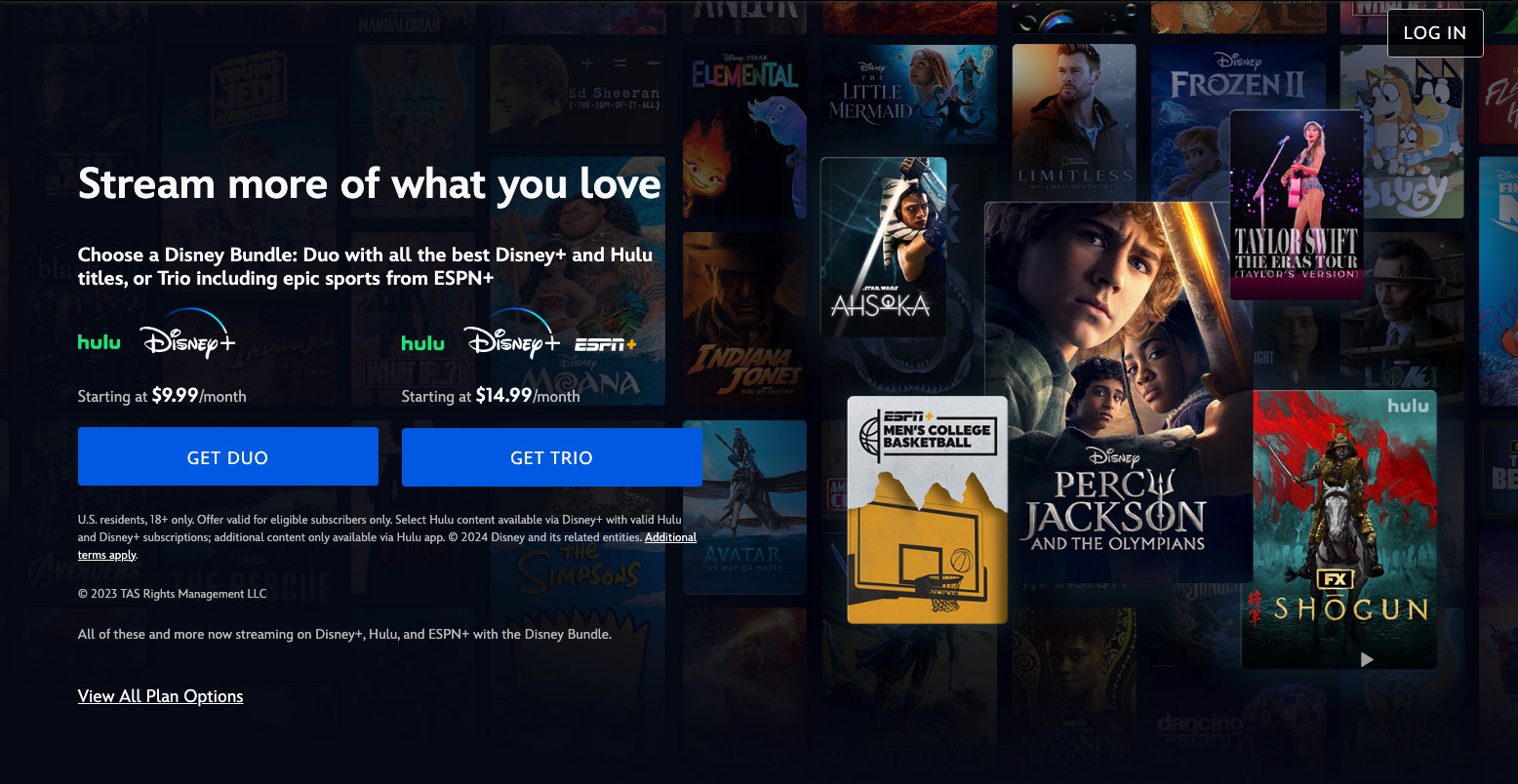

The ‘before’ version of the Disney+ homepage with blue buttons and accents.

It also introduced a greener version of the Disney+ logo and app icons (dare we call it “Dulu”?).

The homepage had previously been updated to focus on the Hulu-Disney+ bundle (along with the “trio” of Hulu-Disney+-ESPN+), even placing the Hulu logo first in the row of logos representing services.

Hulu’s site remains largely the same, including retaining its green coloring, and continues to steer users toward bundles.

Collectively, these offerings are referred to as the “Disney Bundle.”

Disney+ was and still is available by itself, as are both Hulu and ESPN+. There are also ad-supported and ad-free options the Hulu-Disney+ bundle. Subscribing to a bundle vs. individual streamers saves between 37% and 44%, depending on the exact options selected.

Consumers on an ad-support Disney+ tier can add Hulu for only $2 more per month, pricing that has been around prior to the integration updates. The upgrade cost for both streamers without adds is $6 per month.

ESPN+ is not directly integrated with Disney+.

Meanwhile, Disney is planning a marketing campaign to encourage users to sign up for the new, more tightly-integrated bundle, using the White Stripes’ “We’re Going to Be Friends” song as a theme.

Disney, like other streamers, has been under pressure to stem losses from its DTC video businesses. Many media companies have poured money into building and promoting both SVOD and FAST streaming offerings as traditional linear TV consumption continues to decline. Advertising supported tiers have also become more popular as streamers look for ways to offer more appealing prices to consumers frustrated with shelling out for multiple subscriptions each month to get all the content they want.

Many streamers have also discovered that selling ads ends up being more financially advantageous to them, with ad revenue often able to outpace what they would have collected via a slightly higher subscription price.

Disney has long maintained a stake in Hulu, which was originally launched as a joint venture between News Corp. (Fox), NBCUniversal and an equity investment firm. In late 2023, it opted to buy out Comcast’s stake in the streamer, giving it broad control over the platform.

Disney is notable among major media outlets in that it operates two large separate, general interest paid streaming brands with distinct content from each other, though the new integration does put a small dent in that strategy.

Warner Bros. Discovery continues to market both its flagship streamer Max (originally HBO Max) and Discovery+, but Discovery+ content is all available directly within Max. A separate plan with only Discovery content is still sold but not marketed as heavily.

Disney has long touted Disney+ as the home to its signature content plus several key franchises, including Marvel, Star Wars (Lucasfilm) and more, while Hulu tends to feature broader content from across the Disney, ABC and former 21st Century Fox brands Disney acquired in 2019.

Hulu is also distinct in that it offers a subscription television offering similar to cable or satellite packages called Live TV (there is also a cloud-based DVR feature).

NBCUniversal, parent of NBC, offers Peacock, which formerly had a free ad-supported tier but now offers solely under paid plans, while also funneling content to its FAST joint venture Xumo Play. Paramount Global, meanwhile, operates both SVOD Paramount+ as well as FAST Pluto TV.

Even Amazon, which doesn’t have ties to a traditional network, has a paid option via Prime Video and completely-free option with Freevee.

So far, Disney has yet to venture fully into the FAST market, instead opting to invest in and market two separate SVODs, albeit with some ad-supported tiers.

Disney has undoubtedly been shifting to marketing Hulu and Disney+ more as a single offering but has yet to make a full merger between brands official. With the new in-app integration now available, Disney is further blurring the lines between the two brands.

That said, there are advantages to maintaining the both names. Hulu has strong name recognition despite being around 100 years younger than the Disney name. It also can help drive home the fact that it offers much more content beyond just Disney-associated material (a strategy that WBD appeared to play into when it dropped “HBO” from “HBO Max” and went with just “Max”).

Bundling two services also creates a feeling of better value in the minds of consumers when the actual costs of providing the same household with two separate streamers is arguably becoming less and less significant; perhaps even more so if the subscriber opts for an ad-supported plan, meaning Disney has more opportunities to show more ads given the broader content base.

Hulu is still available as a standalone app and Disney will continue to sell subscriptions to it separately.

Subscribe to NCS for the latest news, project case studies and product announcements in broadcast technology, creative design and engineering delivered to your inbox.

tags

Disney Plus, Free Ad-Supported Streaming Television (FAST), Hulu, OTT, streaming, SVOD, Xumo Play

categories

Broadcast Industry News, Heroes, Streaming